The Rise and Pause of Bally’s Chicago Casino: A Timeline of Ambition, Controversy, and Urban Transformation

Chicago’s first-ever integrated casino—Bally’s Chicago—is poised to reshape the River West neighborhood and the city’s economic landscape. With an estimated $1.7 billion price tag, a 500-room hotel, 4,000 gaming seats, and a sprawling entertainment district along the Chicago River, the project represents a landmark public-private partnership. Yet, as steel rose and demolition crews cleared the former Tribune publishing plant, a cascade of political, legal, and regulatory hurdles threatened to stall the dream. Below, we chart the key milestones and missteps in the Bally’s Chicago Casino saga, examining how vendor vetting lapses, mob-link allegations, and high-stakes lawsuits have put urban development, regulatory compliance, and public-private collaboration under the microscope.

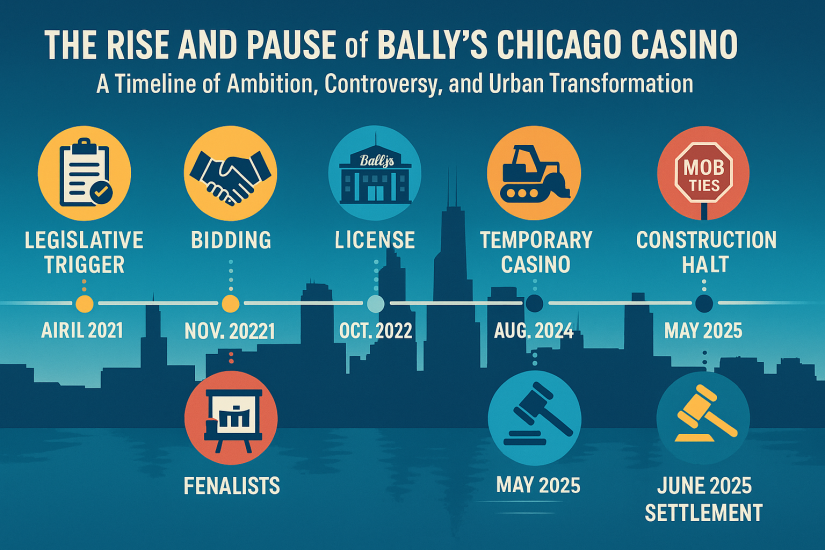

A Detailed Timeline of Bally’s Chicago Casino Development

June 2019 – Governor J.B. Pritzker signs legislation expanding gambling statewide, laying the groundwork for a Chicago casino study en.wikipedia.org.

April 2021 – Mayor Lori Lightfoot launches the formal bidding process, seeking proposals for a casino-resort with a 500-room hotel and extensive entertainment offerings en.wikipedia.org.

November 2021 – Chicago officials trim the field to five finalists, highlighting site plans from Rush Street Gaming, Bally’s, Hard Rock, and others en.wikipedia.org.

March 2022 – Three finalists remain: Rush Street, Bally’s (at the Tribune printing plant in River West), and Hard Rock (near Soldier Field) en.wikipedia.org.

May 5, 2022 – Lightfoot selects Bally’s bid; City Council approval follows later that month. The Host Community Agreement (HCA) mandates 25% minority ownership and firm commitments to local hiring en.wikipedia.org.

December 2022 – City Council formally greenlights the project; the Illinois Gaming Board (IGB) grants a permanent license in October en.wikipedia.org.

September 9, 2023 – A temporary casino opens in the Medinah Temple, generating revenue but falling short of projections (25% of expected in Year 1; 47% in Year 2) en.wikipedia.org.

August 2024 – Demolition of the Tribune site begins, replacement of the Chicago Avenue bridge is planned, and construction crews break ground on the permanent resort en.wikipedia.org.

May 2025 – Construction halts abruptly when the Illinois Gaming Board uncovers that an unapproved vendor—D&P Construction, once tied to reputed Chicago Outfit bosses—has been supplying site dumpsters. The IGB orders an immediate work stoppage as it probes the vendor’s mob-link allegations casino.orgvegasslotsonline.com.

June 2025 – Bally’s, the city, and regulators settle a high-profile lawsuit over the HCA’s race- and sex-based investment quotas; terms remain confidential axios.com.

The Unapproved Vendor and Mob-Tie Allegations

In early May 2025, the IGB issued a cease-work order after Chicago Sun-Times reporters noticed dumpsters emblazoned with the logo of D&P Construction Co. on the River West site. D&P was once controlled by Peter and John DiFronzo—alleged Outfit bosses whose intimidation tactics in the early 2000s torpedoed a Rosemont casino bid. The IGB’s investigation centers on undisclosed, unapproved vendors: under Illinois law, all contractors must be vetted and approved to prevent organized crime infiltration. Until Bally’s demonstrates robust new vetting protocols, construction remains on ice—a stark reminder that regulatory compliance is non-negotiable in public-private ventures casino.orgvegasslotsonline.com.

Political and Legal Controversies: From IPO Quotas to Discrimination Lawsuits

The Host Community Agreement Lawsuit

As part of the HCA, Bally’s offered an IPO exclusively to women and minorities—capping 10,000 shares for investors meeting the city’s diversity criteria. In January 2025, the Liberty Justice Center filed Glennon v. Johnson on behalf of white investor Mark Glennon, arguing the quotas violated the Equal Protection Clause. The lawsuit named Mayor Brandon Johnson, City Treasurer Melissa Conyears-Irvin, the IGB members, and Bally’s Operating Company. Critics hailed the case as “blatantly discriminatory,” while proponents saw it as vital to rectify historical inequities. The case underscored the tension between social equity goals and constitutional protections libertyjusticecenter.orgtampafp.com.

Settlement and Ongoing Challenges

In June 2025, Bally’s and the city quietly settled the lawsuit without disclosing terms. Regulatory filings confirm that Bally’s removed the race quotas from its IPO, though it still prioritizes Illinois residents. The gambit cost Bally’s valuable time and added legal expenses—yet it highlights how public-private agreements must balance diversity ambitions with airtight legal frameworks axios.com.

Implications for Urban Development

Bally’s Chicago Casino is more than a gaming hall; it’s a catalyst for riverfront rejuvenation. The project promises 2 acres of public park, a 1,000-person outdoor concert venue, and new transit connections. But each delay reverberates through local small businesses, construction suppliers, and workforce training programs. Urban planners warn that halts can deter investors in adjacent developments. Chicago’s experiment in large-scale mixed-use gaming resorts now serves as a case study: ambitious urban development requires an ecosystem of stakeholders to operate in harmony, anchored by transparent agreements and vigilant oversight.

Lessons in Regulatory Compliance

The D&P Construction episode illustrates the perils of lax vendor management. Public agencies and private developers alike must adopt rigorous “know-your-contractor” protocols, including FBI background checks and forfeiture of work orders for non-compliance. The IGB’s swift action preserved the integrity of Illinois gaming law but inflicted costly downtime. For future mega-projects, regulators may mandate real-time vendor reporting systems and staggered compliance audits to nip organized crime risks in the bud.

Public-Private Partnership: A Delicate Balance

Bally’s Chicago exemplifies how municipalities leverage private capital to fund public priorities—pension underfunding, community reinvestment, and economic stimulus. The HCA model allocates casino revenues to police and firefighter pensions, minority business outreach, and local infrastructure. Yet the push-pull between city officials, community advocates, and corporate interests can spawn lawsuits, tax-break disputes, and reputational risks. In January 2025, Mayor Johnson clashed with Bally’s over a $300 million property tax break—arguing the HCA did not authorize such incentives. The debate highlighted that every concession in a public-private partnership must be documented, transparent, and consistent with community goals chicago.suntimes.com.

What’s Next for Bally’s Chicago Casino?

As of June 2025, Bally’s has proposed a new vendor-approval framework and resumed demolition work on less contentious site elements. The IGB’s pending report will determine whether the halt extends beyond summer. Should Bally’s clear the vendor hurdle, construction could accelerate toward a late 2026 opening. But the project’s odyssey—a blend of high stakes, legal showdowns, and regulatory red flags—offers a cautionary tale for cities nationwide. The saga affirms that bold urban development, when fused with meticulous compliance and equitable partnerships, can redefine a skyline. Yet even the grandest vision can be grounded when procedural fail-safes are overlooked.

Key Takeaways:

- Timeline & Milestones: From legislative triggers in 2019 to construction halts in 2025, each phase illustrates the complexity of mega-projects. en.wikipedia.org

- Regulatory Vigilance: Unapproved vendors with alleged mob ties prompted an immediate IGB work stoppage, underscoring vendor-vetting imperatives. casino.orgvegasslotsonline.com

- Political & Legal Risks: Diversity quotas in Host Community Agreements can invite constitutional challenges if not crafted with legal precision. libertyjusticecenter.orgtampafp.com

- Urban & Economic Impact: Delays in mixed-use developments affect neighboring businesses, transit plans, and investor confidence.

- Public-Private Balance: Transparent, enforceable agreements are essential to align corporate ambitions with civic priorities. chicago.suntimes.com

Chicago’s first integrated casino remains a beacon of urban renewal—but only if the lessons of regulatory compliance and equitable partnership are heeded. The road to 2026 may be bumpy, but the promise of jobs, tax revenues, and a vibrant riverside district still shines bright.